-

-

Notifications

You must be signed in to change notification settings - Fork 1.2k

is there a way to get final PnL in pips #8

New issue

Have a question about this project? Sign up for a free GitHub account to open an issue and contact its maintainers and the community.

By clicking “Sign up for GitHub”, you agree to our terms of service and privacy statement. We’ll occasionally send you account related emails.

Already on GitHub? Sign in to your account

Comments

|

IIUC, the final P/L in money and percentage is already provided: backtesting.py/backtesting/backtesting.py Line 881 in a7d1d4f

backtesting.py/backtesting/backtesting.py Line 883 in a7d1d4f

For the P/L in pips, you can divide the backtesting.py/backtesting/_util.py Lines 100 to 101 in a7d1d4f

Does this work for you? |

|

Thanks.

so result['Equity Final [$]']/pip_size, I though this would have been true

if the position size for every trade was exactly the same, but in our case

the position size is the max amount, while the equity is growing or

falling, where's the catch?

…On Thu, Jul 4, 2019 at 4:23 PM kernc ***@***.***> wrote:

IIUC, the final P/L in money and percentage is already provided:

https://github.com/kernc/backtesting.py/blob/a7d1d4f3fa658290182dfa2fdbf69bffe6a8f018/backtesting/backtesting.py#L881

https://github.com/kernc/backtesting.py/blob/a7d1d4f3fa658290182dfa2fdbf69bffe6a8f018/backtesting/backtesting.py#L883

For the P/L in pips, you can divide the s['Equity Final [$]'] value by

pip size. If you don't know it, backtesting.py uses the following heuristic

formula to determine it from closing values:

https://github.com/kernc/backtesting.py/blob/a7d1d4f3fa658290182dfa2fdbf69bffe6a8f018/backtesting/_util.py#L100-L101

—

You are receiving this because you authored the thread.

Reply to this email directly, view it on GitHub

<#8?email_source=notifications&email_token=AE7J6THA5RETK75AAHKY7KTP5X2TLA5CNFSM4H52BIO2YY3PNVWWK3TUL52HS4DFVREXG43VMVBW63LNMVXHJKTDN5WW2ZLOORPWSZGODZHM4EY#issuecomment-508481043>,

or mute the thread

<https://github.com/notifications/unsubscribe-auth/AE7J6TGVWPV43NJIPEYDCELP5X2TLANCNFSM4H52BIOQ>

.

--

Kindest regards,

Eduard Samokhvalov

Phone

+7 977 119 23 66

Web

https://packandsell.org

LinkedIn

https://www.linkedin.com/in/esamokhvalov/

Skype

edward.samokhvalov

|

The equity changes along with asset price. Indeed, self.position.pl / self.data.pipwithin bt = Backtest(...)

result = bt.run()

per_trade_pips = result._trade_data['P/L'].dropna() / pip_size |

|

Or ... if you are interested in mere price difference in pips of your individual trades, you have to additionally divide by position size in self.position.pl / self.position.size / self.data.pip

# or

(self.data.Close - self.position.open_price) / self.data.pip # (*-1) for short positionsOr, at the end of a backtest run, using undocumented API: td = res._trade_data

td = td.ffill().loc[td['P/L'].dropna().index]

(td['Exit Price'] - td['Entry Price']) / pip_size |

|

I understand the suggestion here is to amended |

|

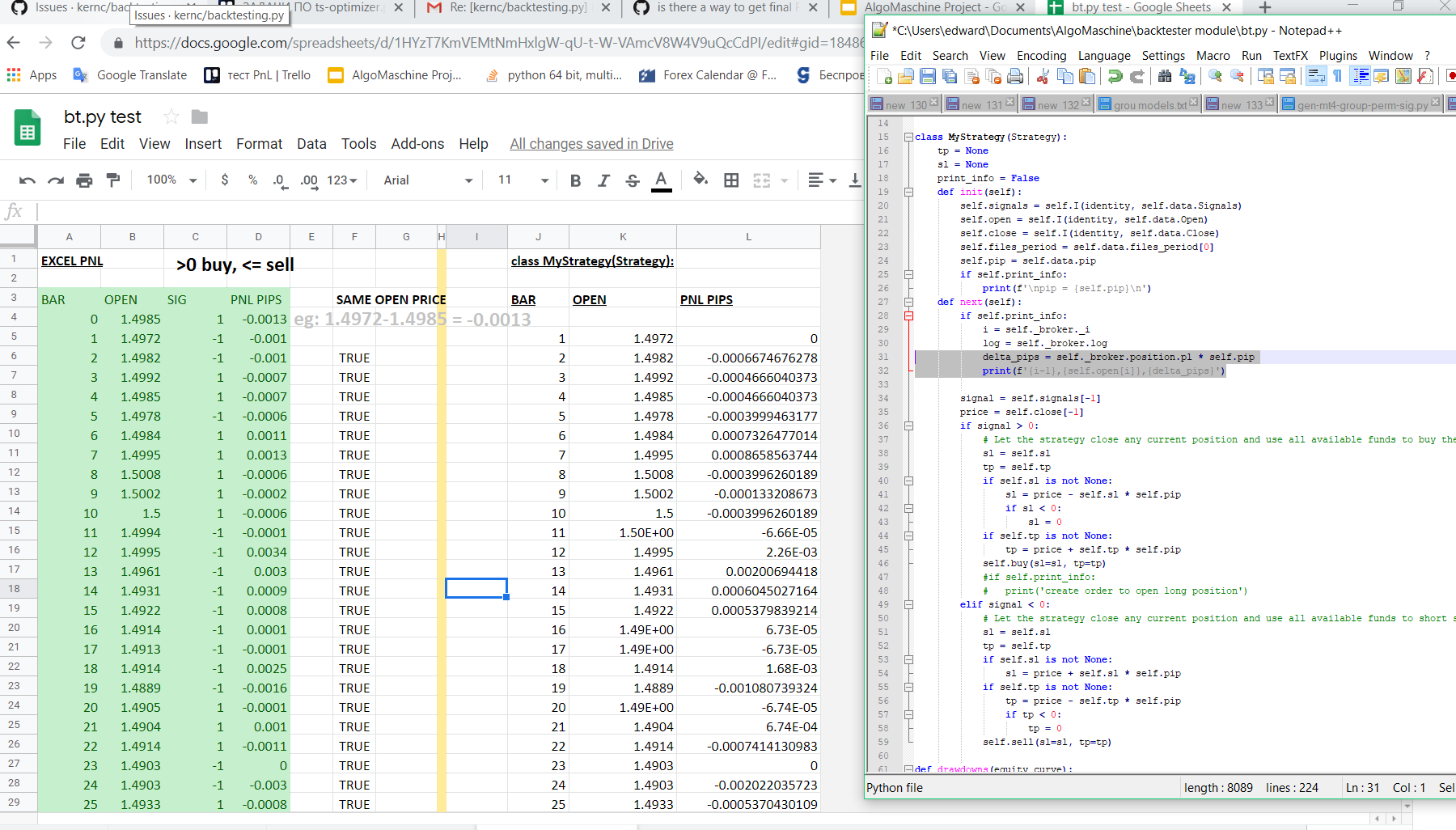

Dear Kernc, Here's the screenshot of PnL calculated in Excel VS debug data from the Python class. I've attached the screenshot, data (open price/signals in sample.txt) and code. The comparison values are in google sheets here. Your help is appreciated a big time. The python.txt file contains code. |

|

In delta_pips = self.position.pl / self.position.sizeIn order to get this value in terms of number of pips, you have to, additionally, divide by pip size: pnl_in_pips = self.position.pl / self.position.size / self.data.pip |

|

Thanks for the tip. It seems to work now. |

|

As PnL in pips is easily computable, |

Expected Behavior

PnL in pips

Actual Behavior

PnL in money or percentage, which is also useful

The text was updated successfully, but these errors were encountered: